Credit scores are the modern marker of economic reliability. How likely is it someone will pay their bills on time and across time? The effectiveness of this score as a marker of these questions is uncertain. Although the importance of credit and credit scores are undeniable.

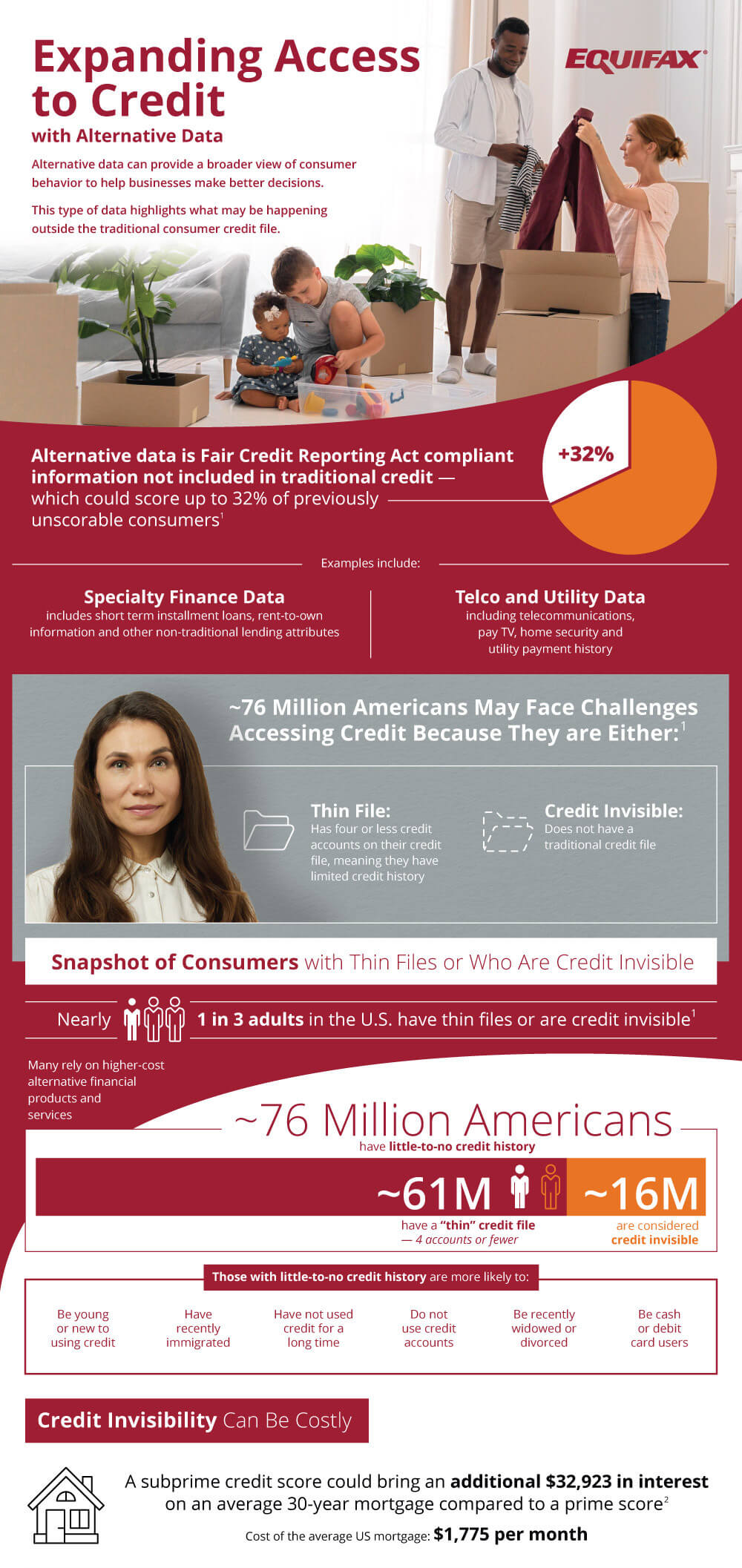

There’s nowhere this importance is revealed more than in those who are credit invisible. Credit invisibility is when one has so few credit sources that they do not have a file. What this means practically varies, but is almost never good.

It typically means loans will have massive interest rates. It means denial of certain types of loans. It can mean predatory sources of money and essentials become a necessity. And it means life just gets that much harder.

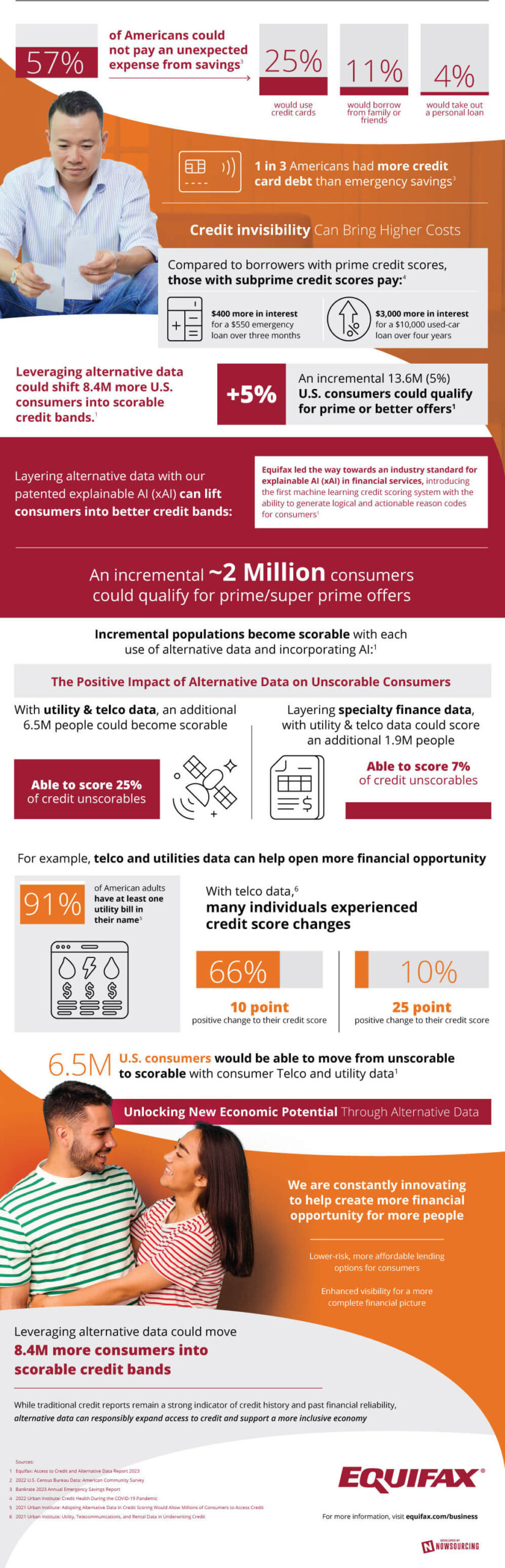

Luckily it’s not hard to escape invisibility through one small credit account. Although many Americans prefer debit, or are recent immigrants, or divorcees, or aren’t educated on these things. This is where modern alternative credit scoring can come in. Alternative data, things like telephone bills and utilities, can be considered alongside credit accounts to move someone into visibility.

The best part about this over forcing someone to use credit accounts is that it requires no change. The consumer simply has a credit score one day as a reward for always paying their bills on time. What’s different is simply which bills are affecting that score in the first place. It’s something which could move 8.4 million more consumers into scorable ranges.

This is one avenue for Americans to escape credit invisibility, but it’s still a struggle. More than anything Americans need education on the system. Credit is not to be feared, but used as a valuable tool. It’s only when abused or neglected that credit accounts become a source of debt and anxiety.

Infographic Source: https://www.equifax.com/newsroom/all-news/-/story/infographic-expanding-access-to-credit-with-alternative-data-1