Cars are undoubtedly expensive, and losing them or getting them damaged can further drain one’s finances. It’s vital to protect one’s property so they can fully enjoy them until they need to look for a replacement. It’s essential to get comprehensive car insurance to secure your finances in case an accident happens.

Not every driver is a responsible driver, and they’re also not the only reason why car accidents occur. The weather, the road’s condition, and your own vehicle’s status are significant factors that can result in vehicular accidents. Not having insurance keeps a driver from being protected should anything happen to their car.

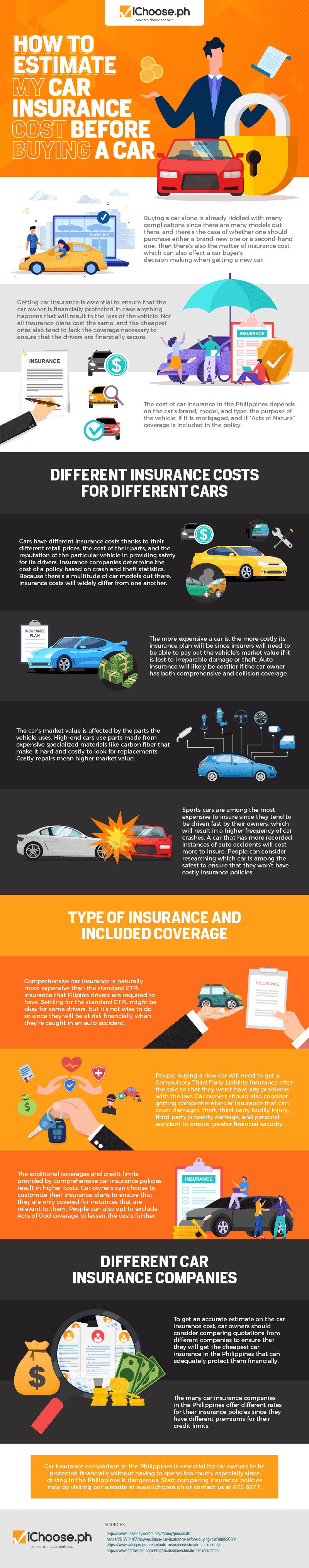

Comprehensive insurance plans can cover various expenses in an accident, including third-party liability, third-party property damage, own damage, theft, and personal accident. Some insurance policies can also cover Acts of God, so cars damaged due to storms, earthquakes, and others can be secured.

Insurance isn’t necessarily expensive as long as people compare insurance policies before getting one. Generally, an insurance plan’s cost is dependent on the car’s price, model, cost of parts, and reputation. Insurers also offer different policies, and some may be cheaper than others.

Many people avoid getting insured because they think insurance is expensive. People can generally estimate how much an insurance plan is checking on the car, even before buying it. To know more about estimating insurance cost, see this infographic.

Infographic Source: https://ichoose.ph/blogs/estimate-car-insurance-cost-buying-car-infographic/