One of the great things about investing in real estate is the variety of options you can choose from, such as an apartment complex or a condominium unit. Depending on your stage in life, real estate is a good investment for your goal of having enough assets as you reach your golden years.

Whether you’re securing your property legacy through an asset protection plan and leaving it to your loved ones or capitalizing on it, real estate is always considered a great investment when the value of a condo is worth more than the purchase price.

There are various reasons why condo owners decide to rent out their space. Aside from the fact that it can generate them regular cash flow, it can also be because their family is getting bigger, making a condo unit unideal for their growing size. Perhaps they’ll be working abroad for a while, and they want to earn extra from their vacant unit.

If you want to make passive income, you can turn your condo unit into a money-making property or invest in one and rent it out. If you happened to score a condo at a relatively low price (especially in prime areas), no more dead investment on your end here.

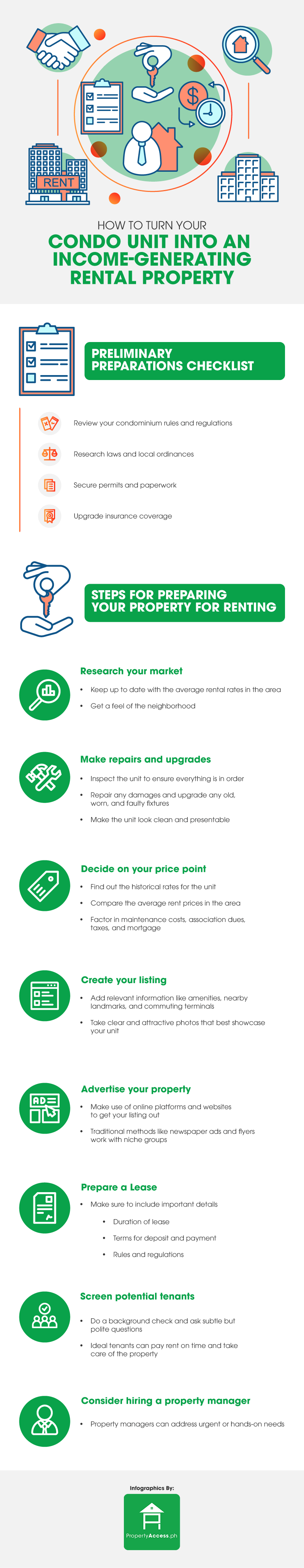

Of course, you’ll have to go through several steps to make sure you’re prepared for it and to maximize your earnings. From securing permits and paperwork to reviewing your insurance coverage, you have a lot to take into account before posting a property advertisement.

Take a look at the infographic below to help you walk through the process of preparing your property for renting and turning it into a steady source of income stream. If you want to become a good landlord, make sure to tick all the points in the checklist. Let’s dive into it!