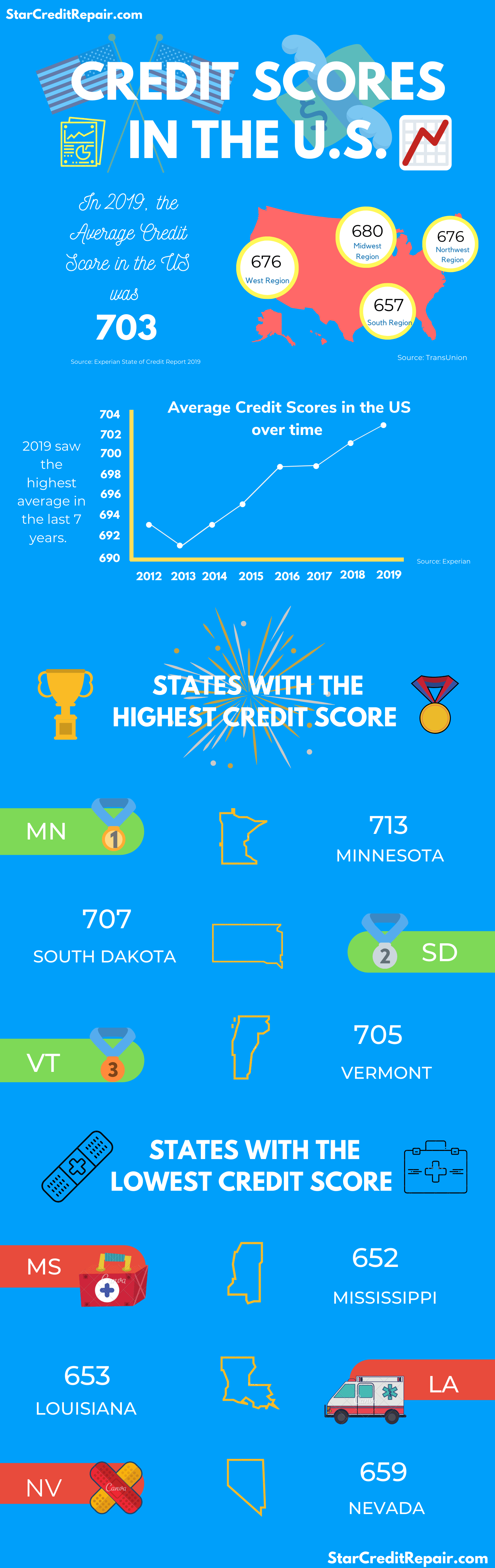

Every year, millions of Americans apply for loans to buy a home, finance a car, pay for education, and start businesses. Unfortunately, 30% of those same Americans may struggle with fair to poor credit. Credit scores can play a large role in determining eligibility for a loan. Those with excellent credit have a better chance of loan approval and a lower interest rate. However, applicants with fair and poor credit may struggle with application approval and getting a loan at a lower interest rate. Wherever a person may be on the credit score scale, it’s important to acknowledge that credit is a large part of the American lifestyle and can influence certain outcomes. Based on a number of data reports from Experian and Transunion, our infographic takes a look at the average credit scores in regional zones across the US, the average credit score in the US over the last 7 years, as well as US states with the highest and lowest credit scores.

Infographic Source: https://starcreditrepair.com/infographic-credit-scores-in-the-us/